From the CEO

“Hungry developers intent on a quick quid from their development are the greatest threat to peaceful communities in WA. They use every sneaky trick in the book to circumvent local voices, supported by their lobbyist mates, and it seems, the UDIA.”

This quote by a former City of Bunbury Councillor of 12 years was in The West’s Letters to the Editor today in response to the opinion piece I wrote and was published (not paid by UDIA as an advertorial as another claimed..) in the same paper yesterday.

I am completely unsurprised and undeterred by this response. It’s indicative of a long held perception by many that our industry is run by greedy hacks who seek to cash in on unsuspecting homebuyers leaving a trail of devastation in their wake. And that is putting it mildly when you read the pages of some local community newspapers.

Yet it is the constituents and the ratepayers that see the inherent value, amenity, sense of vibrancy and community that this industry (with the support of local government) creates that has them trusting us with the biggest investment in their lifetime, their home.

All the sticks and stones that are thrown will not hide the happy homes, playful parks, vibrant streets and communities that are this industry’s legacy. Which fortunately will last well beyond the next media and election cycle.

New season of Home in WA

This week saw the return of Home in WA and UDIA WA were delighted to be part of the first episode in the new season as focused on Fiveight’s plans to revitalise the iconic Indiana Teahouse in Cottesloe.

The proposed redevelopment plans for the Indiana site at Cottesloe by Fiveight reflect the broader need to evolve and meet the community’s needs while maintaining a connection to the history of the area.

Home in WA are UDIA WA’s Media Partner, if you would like to have your business featured on the show and enjoy a 10% discount off your first story, reach out to Executive Producer Ron at dingoistalent@bigpond.com.au and quote UDIA for more information.

To view this first episode in the new Home in WA season, click here.

Expansion of Home Guarantee Scheme

The National Finance & Investment Commission (NHFIC) recently announced an expansion of the Home Guarantee Scheme which was welcomed by UDIA National.

UDIA supports any measure that helps make housing more accessible to more people and the expanded scheme will mean the difference between getting into a home sooner or, for some Australians, spending more time in an accelerating rental market.

The Home Guarantee Scheme is administered by NHFIC, and comprises the First Home Guarantee (FHBG), previously known as the First Home Loan Deposit Scheme, and the Family Home Guarantee (FHG).

The announcement of an increase from 10,000 to 35,000 places per financial year under the First Home Guarantee, in addition to the Family Home Guarantee’s annual allocation of 5,000 places from 1 July 2022 until 30 June 2023, is a positive step toward helping make housing more accessible to more people.

Members will be aware that the Government’s approach dovetails with the UDIA National key policy priority – A Home for Everyone – which recommends removing barriers for entry into the housing market for first home buyers. It also calls for boosting housing supply to reduce costs and improve affordability, by removing impediments including lack of enabling infrastructure, inadequate zoning & planning, delayed development & building approvals, slow environmental decisions.

NHFIC anticipates making 50,000 new Scheme places available to eligible homebuyers in the year ahead, including 10,000 places in the Australian Government’s announced Regional First Home Buyer Support Scheme.

Under the First Home Guarantee, an eligible first homebuyer can purchase a property with a deposit of as little as five per cent, while through the Family Home Guarantee, a single parent with dependents can purchase a home with a deposit of as little as two per cent.

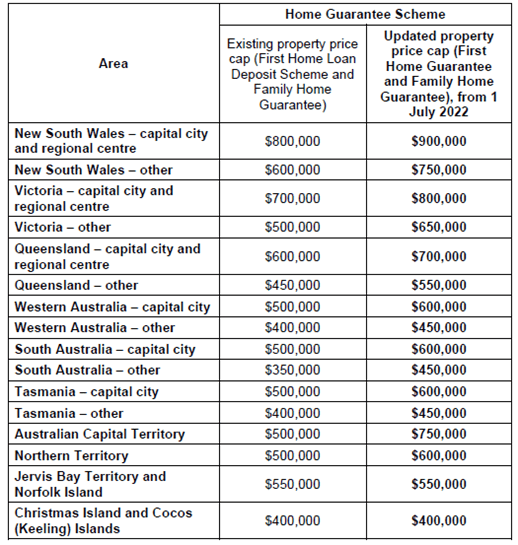

From today updated property price caps will also apply, reflecting recent increases in property prices and to make more properties available for purchase using the Scheme.

This move was also welcomed by UDIA as it will have the potential to increase the number of homes that can be purchased under this scheme.

The table below details the updated property price caps that applies from 1 July 2022.

A further announcement from The Federal Government on its commitment to introducing a suite of policies that will make it easier for Australians to buy a home, and deliver more social and affordable housing includes:

- The $10 billion Housing Australia Future Fund which will build 30,000 social and affordable housing properties in its first five years;

- Help to Buy, a new program to make it cheaper and easier for Australians to own their own home;

- Establishing a National Housing Supply and Affordability Council; and

- Developing a new National Housing and Homelessness Plan.

UDIA National looks forward to working on the implementation of today’s announced measures in order to combat the affordability crisis and help all Australian’s find a home of their own.

The UDIA National media release can be found here.

National unemployment drops to record low

Earlier today the Australian Bureau of Statistics (ABS) released the latest Labour Force figures for June 2022 which showed the National Unemployment rate dropped by 0.4% to sit at 3.5%.

Bjorn Jarvis, head of labour statistics at the ABS, said this is the lowest unemployment rate since August 1974, when it was 2.7% and the survey was quarterly.

“The large fall in the unemployment rate this month reflects more people than usual entering employment and also lower than usual numbers of employed people becoming unemployed. Together these flows reflect an increasingly tight labour market, with high demand for engaging and retaining workers, as well as ongoing labour shortages.”

The fall in unemployment through the pandemic has coincided with large increases in job vacancies (480,000 in May 2022). As a result, there was almost the same number of unemployed people in June 2022 (494,000 people) as vacant jobs.

“This equates to around one unemployed person per vacant job (1.0), compared with three times as many people before the start of the pandemic (3.1)”, Mr Jarvis said.

Despite the drop in unemployment figures nationally, WA’s rate rose to 3.4%, up from 3.1% in May and 2.9% in April 2022. The slight increase sees WA’s rate third lowest of all States behind Victoria (3.2%) and NSW (3.3%).

WA’s underemployment rate also increased by 0.3% in June, rising to 5.7% however this is the lowest underemployment rate of all states and territories with the exception of the ACT which recorded an underemployment rate of 4.7%.

WA also enjoys the highest participation rate of all the States despite a 0.3% drop in this month’s figures.

New Keystart loan to support urban infill goals and boost home ownership

Yesterday the State Government announced the launch of Keystart’s Urban Connect Home Loan, a new loan product that can be used to purchase apartments in medium and high-density developments with two or more bedrooms, close to transport hubs and in urban locations.

The loans are designed to support the McGowan Government’s infill priority announced in the 2022-23 State Budget and make property ownership easier for Western Australians.

Loans will be available for off-the-plan, new and established apartments with a minimum of two bedrooms in a complex of two storeys or more, under the two-year pilot capped at 300 loans.

Income and property purchase limits for the Urban Connect Home Loan are a sole income of $180,000 for singles with a property purchase limit of up to $550,000, and combined income of $200,000 for couples and families with a property purchase limit of up to $650,000.

Keystart has supported more than 121,000 Western Australians in achieving the dream of home ownership since its inception 33 years ago.

Keystart will start accepting Urban Connect Home Loan applications from July 25, 2022.

WA enjoys strong interstate migration

Recent Australian Bureau of Statistics (ABS) data shows thousands of people chose to migrate to WA from interstate Eastern States locales.

Compared to pre-COVID years, WA enjoyed a net interstate migration increase of 11,423 people. In net terms, NSW shed 54,466 residents and Victoria lost 31,726. Over the same period, 3,737 people moved from NSW to WA in net terms.

WA had its largest ever quarterly interstate migration inflow in the final months of 2021 with more than 13,000 people moving west.

Expressions of interest for mentor program with first year Curtin Property students.

The Property Education Foundation are seeking expressions of interest for mentors who would like to be involved in a program that will be embedded into the assessment structure of the Introduction to Property Markets unit.

The commitment from mentors would include:

- A one-hour session where they will be introduced to the Introduction to Property Markets unit, the role of a mentor and to sign a consent form

- Liaising with students via email to arrange a suitable time and place to meet

- Meet for one hour with 3 and 4 students (simultaneously) in a public space, eg a café

- Following the meeting, provide brief feedback to the Unit Coordinator on student interactions.

- This is likely to take place in August/September 2022.

For more information or to submit an Expression of Interest, reach out to Tanya Steinbeck at tsteinbeck@udiawa.com.au.